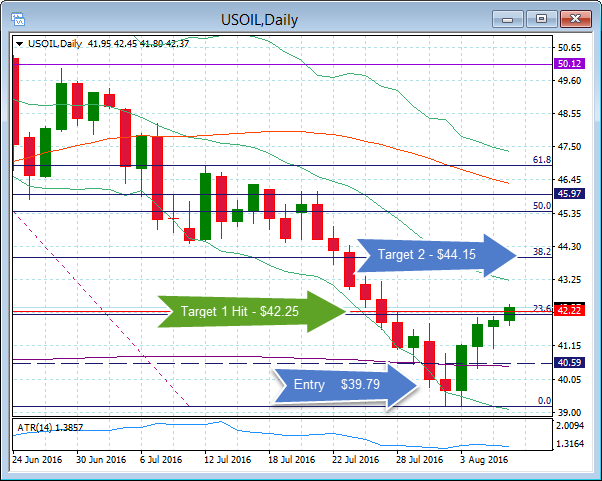

USOil, Daily

On Friday (August 5) I posted my analysis from overnight and the webinar on Thursday for the Oil market and how we were expecting a bounce and retrace from the significant two week decline.

This morning Target 1 was achieved at $42.25 from our entry at $39.79. Target 2 and the 38.2 Fib retracement remains at $44.15. There has been some news from OPEC too this morning that has helped the retrace. They announced that they will meet “informally” on the sidelines at the IEF (International Energy Forum) conference in September. Also that they see demand for oil increasing in Q3 and Q4 and that the decline in the Oil price is only temporary and that higher prices should prevail during the rest of 2016.

In the short term $42.00 and $41.80 could now become a support levels with $42.50 the resistance level, then $43.20 and our target 2 over $44.00.

We used this example in last Thursday’s educational webinar to demonstrate how simple Fibonacci Retracements can be to implement. Join me tomorrow (Tuesday) August 9th at 11:00 GMT when we will be completing another Live Market analysis webinar.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in: [ujicountdown id=”Next Webinar” expire=”2016/08/09 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.