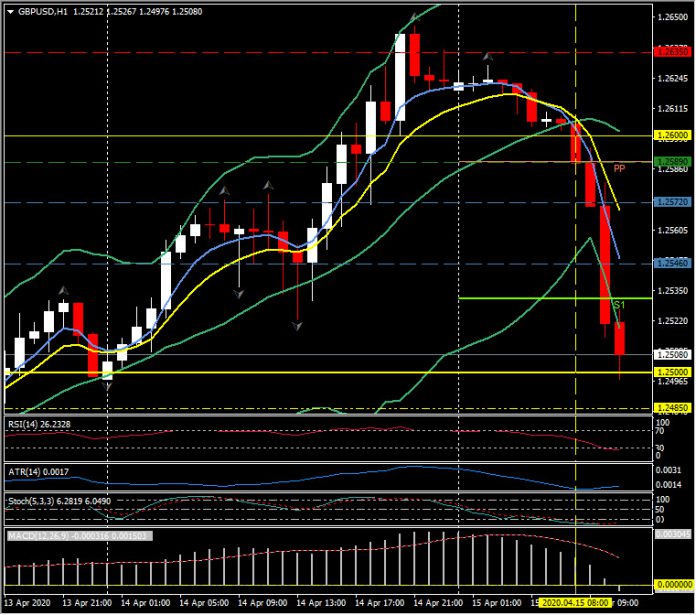

GBPUSD, H1

Sterling remains in demand and is consolidating at highs versus most crosses, but has slipped lower against the Dollar. Cable is being driven by the Dollar move in early European trades and a souring of risk appetite again today. Key US data (Retail sales and Industrial Production) is due before the US session, Cable has turned lower from highs yesterday at 1.2645, breaching 1.2600 and moving quickly to test 1.2500 as the USD bid gains momentum. The 1.2500 level remains key today, with S2 and the 61.8 Fib level co-located at 1.2445 and then the 200-hour moving average at 1.2408.

The H4 time frame has just completed a move form April 8 at 1.2372, breaking back below the 9-period EMA at 1.2512 for a 140 pip gain.

The H4 time frame has just completed a move form April 8 at 1.2372, breaking back below the 9-period EMA at 1.2512 for a 140 pip gain.

The Daily time frame is into its fourteenth day (170 pip) above the 20-day moving average, and moving down today for the first day in seven having stalled shy of the 200-day moving average yesterday. A breach of 1.2650 will be required to continue the move higher. The Daily ATR from March 27 was 350 pips.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.