The Australian Dollar tumbled to fresh major-trend lows versus the US Dollar following a big miss in Q4 construction data out of Australia, which contracted 3.0% q/q versus the median forecast for -1.0%. The data suggests Q4 GDP may be weaker than expected, and that’s before the Q1 impact of the worst-in-decades wildfires, the sharp drop in Chinese tourist visits over the Lunar New Year period and other economic disruptions caused by the coronavirus outbreak.

AUDUSD hit a new 11-year low at 0.6569. A strong bearish February candle below the multi-year low (0.6660 since 2009) could force the asset onto the back foot to decade lows, i.e. down to 0.6250.

Elsewhere, Yen crosses have mostly followed suit, though AUDJPY printed a 23-day low at 72.48, nearing the four-and-a-half-month low that was seen in early February at 72.41. As risk aversion continues to dominate and the focus remains on virus developments and headlines, with investors clearly taking a decidedly more pessimistic view on the impact than central banks, AUDJPY is a strong indicator and predictor of future risk-on activity in global markets.

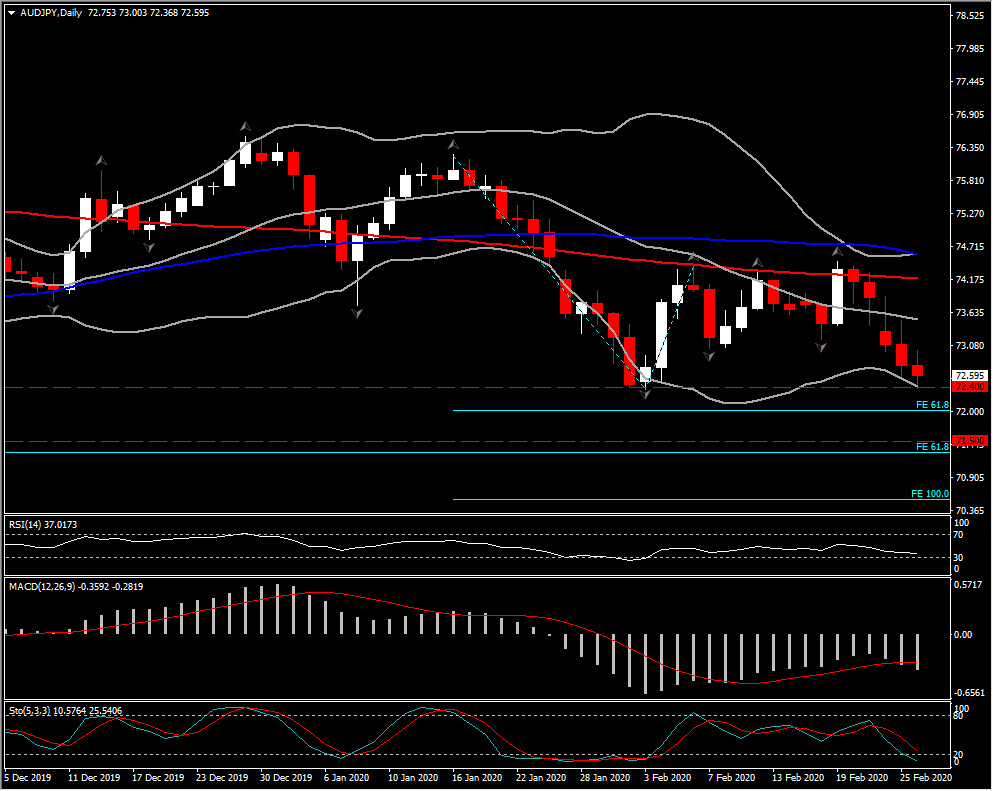

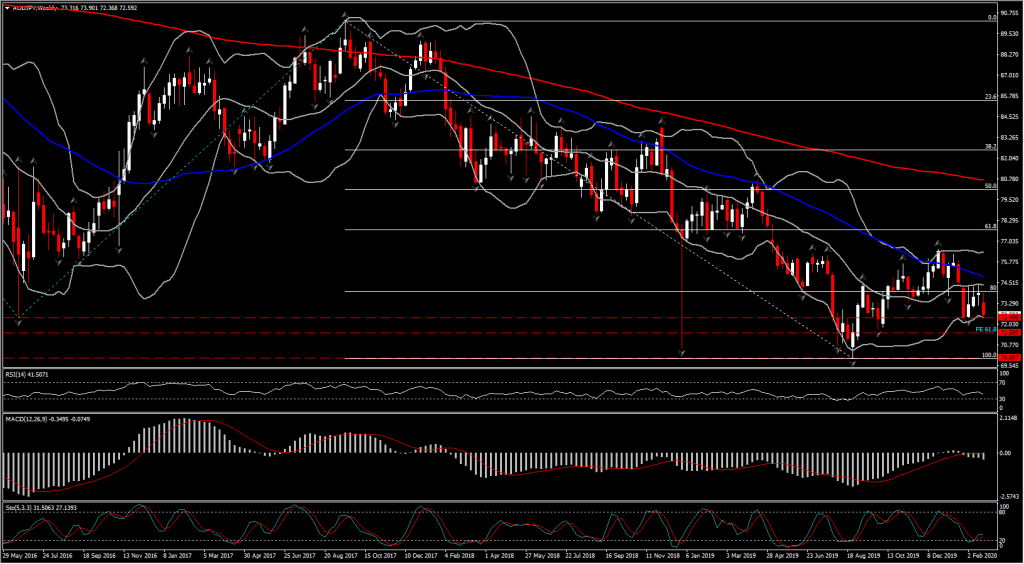

The asset is currently testing a key short term support at month’s low at 72.40, while another Support could be at the FE61.8 from January’s swing, at 72.10. In January we saw a general refreshment in the fall seen since September 2017. A repetition of January’s 8-bear daily candles, is likely to be seen in the near future as the AUDJPY has already formed 4 consecutive ones presenting the growing bearish momentum.

From the technical perspective, today’s pessimism looks strong as AUDJPY failed to gain some ground, while it is now testing the lower BB pattern at 72.40 as mentioned above. The RSI is now around 41 and the MACD lines have flattened in the negative area, preparing for a fresh bear cross whilst Stochastic has already formed one. The RSI, MACD and Stochastic, all look to be lead indicators for a further deterioration of AUDJPY, in the long and short term.

Ahead, it’s clear that the COVID-19 virus hasn’t reached peak contagion rate, and the media hype and (arguably) panicky responses by governments — with the consequence of economically disruptive containment measures — seems more likely to grow than to wane at this point. Further bouts of pronounced risk-off positioning therefore seem to be in store. Ultimately, the proclivity for viruses to weaken as they pass through populations, coupled with the remedying influence of upcoming spring weather in the northern hemisphere, along with efforts to contain the spread, should bring an end to COVID-19.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.